Contractor loans provide a vital solution for self-employed contractors facing financial challenges, offering specialized financing for materials, labor, and business overhead. These loans, including short-term, long-term, and government-backed options, empower businesses to take on bigger projects, grow, and ensure consistent cash flow in the competitive construction market. While they offer flexibility, challenges like higher interest rates and strict eligibility criteria exist. By systematically assessing needs, preparing documents, comparing options, and choosing a suitable loan, contractors can successfully secure funding for expansion and achieve sustainable success.

In today’s competitive construction landscape, accessing capital is crucial for contractors aiming to secure projects and grow their businesses. Understanding contractor financing options, such as loans, opens doors to unprecedented opportunities. This article delves into the intricacies of contractor financing, exploring various loan types available to business owners, their benefits and challenges, and a step-by-step guide to securing funding. We also present compelling case studies, showcasing real-world success stories in contractor financing. Discover how these strategies can propel your construction venture forward with access to much-needed capital.

- Understanding Contractor Financing: Unlocking Access to Capital

- Types of Contractor Loans: Options for Business Owners

- Benefits and Challenges: Weighing the Pros and Cons

- How to Secure a Contractor Loan: A Step-by-Step Guide

- Case Studies: Real-World Success Stories in Contractor Financing

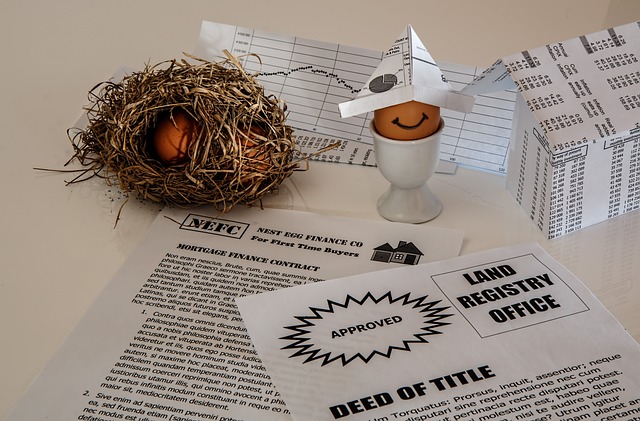

Understanding Contractor Financing: Unlocking Access to Capital

For many contractors, accessing capital can be a significant challenge. Traditional financing options often exclude self-employed individuals, leaving them to navigate projects without the financial support they need. Contractor loans, however, present a game-changing solution. These specialized financing options are designed specifically to meet the unique needs of contractors, offering flexible terms and immediate access to funds.

Understanding contractor loans involves recognizing their role in democratizing access to capital. By providing funding for materials, labor, and overheads, these loans empower contractors to take on larger projects, expand their business, and secure a steady cash flow. In today’s competitive market, unlocking this access to capital can be the key to success and sustainable growth.

Types of Contractor Loans: Options for Business Owners

Contractor financing is a vital topic for business owners in the construction industry, as accessing capital can be a significant challenge. There are several types of contractor loans designed to cater to the unique needs of contractors and small businesses. These options include short-term loans, also known as line of credits, which offer flexibility and quick access to funds. This type of loan is ideal for covering immediate expenses and managing cash flow during busy periods.

Another popular choice is the long-term loan, typically used for larger projects or business expansion. These loans have more extended repayment periods, providing contractors with the financial stability they need to manage lengthy construction projects. Government-backed loans are also available, offering competitive interest rates and favorable terms, making them an attractive option for responsible borrowing. Each type of contractor loan has its advantages, catering to different business requirements and ensuring contractors can access the capital needed to thrive in a highly competitive market.

Benefits and Challenges: Weighing the Pros and Cons

Contractor financing, specifically through contractor loans, offers a range of benefits for construction professionals. Access to capital is a significant advantage, allowing contractors to secure funding for equipment, materials, and labor. This financial support can expedite project timelines and enable businesses to take on larger, more ambitious projects. Moreover, these loans often come with flexible terms and customizable repayment options tailored to the unique cash flow patterns of construction projects.

However, challenges accompany this financing method. Interest rates on contractor loans can be higher compared to traditional banking options, adding up over time. Additionally, contractors may face stringent eligibility criteria, including a robust credit history and business financial records. Repayment terms might also pose difficulties if cash flow is unpredictable or project delays occur, potentially leading to financial strain on the contractor’s business.

How to Secure a Contractor Loan: A Step-by-Step Guide

Securing a contractor loan can be a straightforward process if approached methodically. Firstly, assess your financial needs and determine the amount required for your project. Next, prepare your business documents including tax returns, financial statements, and licenses to demonstrate your credibility to potential lenders.

Once your paperwork is in order, compare different financing options available for contractors, such as bank loans, private lenders, or specialized contractor loan programs. Research rates, terms, and requirements carefully. Apply to multiple sources to increase your chances of approval. When applying, be prepared to provide detailed project plans, timelines, and potential customer references. Ensure you understand the repayment terms and choose a loan that aligns with your business model and cash flow capabilities.

Case Studies: Real-World Success Stories in Contractor Financing

In the competitive world of construction, accessing capital can be a game-changer for contractors. Case studies of real-world success stories highlight the transformative power of contractor loans. For instance, consider a mid-sized renovation company that struggled to secure traditional financing due to a lack of collateral and high credit risk. Through innovative contractor loan programs, they were able to acquire the necessary funds to expand their operations, purchase new equipment, and take on larger projects. This led to increased revenue, improved cash flow management, and ultimately, a stronger market position.

Another successful story involves a small-scale construction startup that leveraged contractor loans to fast-track project delivery and gain a competitive edge. By securing flexible funding options tailored to their unique needs, the company was able to complete projects more efficiently, meet client expectations, and build a solid reputation in the industry. These real-life examples demonstrate how contractor loans can empower businesses to navigate financial challenges, seize growth opportunities, and achieve sustainable success in the construction sector.

Contractor financing, particularly through various loan options, plays a pivotal role in empowering business owners to access capital for growth and project funding. By understanding the different types of contractor loans and their associated benefits and challenges, you can make informed decisions to secure funding that aligns with your specific needs. Following the step-by-step guide and exploring real-world case studies provided in this article, you’ll be well on your way to unlocking the full potential of contractor financing for your business. Remember, leveraging the right contractor loans can transform obstacles into opportunities, paving the path to success.